By Brian Funk

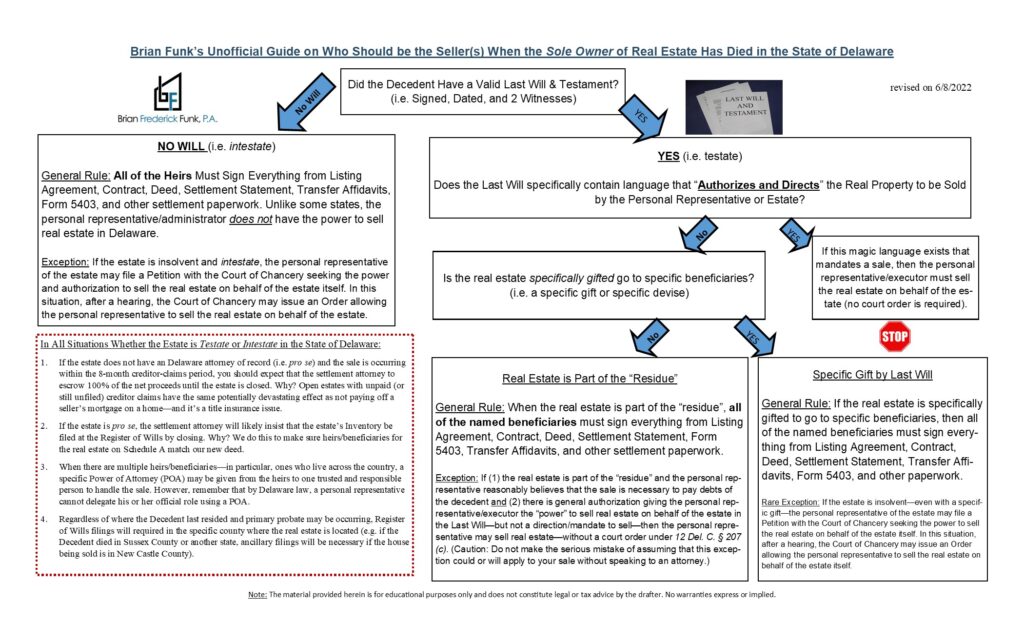

Did you know that unlike some states, in the State of Delaware, when a person died as the sole owner of real estate and died intestate (that is, without a Last Will & Testament, the estate itself is NOT the seller in a sale (subject to a limited exception discussed below)?

When a person dies intestate, under Delaware law, then all the heirs are required to come together and agree to sell that real estate. For most estates where you have a few adult heirs who all get along, it’s usually not too difficult.

More Details

Absent a specific court order, the personal representative (also known as the administrator) of an estate DOES NOT have the automatic power to sell the real estate. The result is that all of the heirs must all hire the listing agent, sign the sales contract, sign the deed, settlement statement, transfer affidavits, and otherwise be agreeable and cooperate for the sale to occur. It can become even more complicated when one of the heirs is a minor or incapacitated (requiring a guardianship)—or worse, simply unreasonable and will not cooperate with the family.

A Limited Exception

If the estate is insolvent and intestate, the personal representative of the estate may file a Petition with the Court of Chancery seeking the power to sell the real estate on behalf of the estate itself. In this situation, after a hearing, the Court of Chancery may issue an Order allowing the personal representative to sell the real estate on behalf of the estate itself.

Planning Ahead

If a person dies with a Last Will & Testament (i.e. testate), the named heir(s) may still be and often are the sellers. However, if the Last Will & Testament specifically “authorizes and directs” the sale of real estate by the personal representative, then the personal representative will be the seller on behalf of the estate (no court order required). Additionally, Delaware law, specifically 12 Del. C. § 207(c), allows for a Decedent to give a limited power to a personal representative to sell real estate—without a court order—if the real estate is part of the “residue” and the personal representative reasonably believes that the sale is necessary to pay debts of the decedent. Alternatively, the real estate can be placed into a Trust and bypass probate altogether.

Recommendation

Regardless of whether there is a Last Will, a Trust, or nothing at all, always hire an estate lawyer to handle probate so that the sale is smoother, and professional legal guidance can be given to the heirs, personal representative, and the real-estate agent from the beginning. When there are multiple heirs—in particular, ones who live across the country—then the estate attorney may recommend that a specific Power of Attorney (POA) be given from the heirs to one trusted and responsible person to handle the sale.

Brian F. Funk, Esq. is a Delaware real-estate attorney who handles to handles transactions on behalf of buyers that regularly involve estates.